Housing White Paper

As one of the fastest-growing cities in the nation, Denver is also home to a housing market leading the nation for appreciation. Naturally, the influx of people and high appreciation rate are causing a housing crisis. The lack of affordable options, from affordable rental properties to the entry-level homes for sale, is making the metro area unaffordable for a large portion of our workforce. The Denver Metro Chamber of Commerce is engaging in this critical issue in order to understand the challenges and potential solutions that will result in a vibrant, diverse community that offers a full spectrum of housing options. Without increased intervention from government, private and nonprofit sectors, our community faces real challenges related to attracting and retaining a diverse, young and qualified workforce.

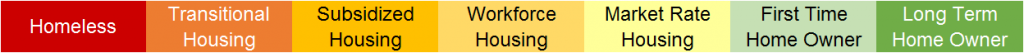

Housing spectrum:

The Challenge:

- Growth in Denver

- Record increases in rental prices and property values

- Shortage of affordable housing and rental units

Growth in Denver

In 2015, Forbes Magazine ranked Denver as the fourth highest metro area for in-migration, ahead of cities like Seattle and Washington, D.C. Between 2010 and 2014, Denver’s population grew by nearly over 68,000 people. Of that, 62 percent was from in-migration, according to the state demographer’s office. Additionally, the size of the millennial population is increasing demand for entry-level market-rate housing, and in turn, increasing rents and the need for affordable housing. Considering projections from the state demographer’s office that estimate Colorado’s population will exceed 7.9 million by 2040, the demand for housing will continue to grow.

At the same time the state’s population is increasing, we are experiencing record increases in rental prices and property values. Denver’s median home price is rising quickly, up nearly 14 percent over the last year. Rents in Denver have increased more than 5 percent a year every year since 2010. In 2014, the spike was 9.2 percent—the highest in the nation that year.

- The median home price in metro Denver is $398,000, up 10.7 percent from the same quarter the prior year. (Over the same year period, wages grew less than 1 percent.) A home in metro Denver cost $175,000 more than the national average ($222,700), and our housing market has earned the dubious distinction of being the most expensive market not located on a coast. Zillow ranked Denver as its hottest housing market for 2016, based on rising home appreciation, strong income growth and low unemployment.

- A buyer of a median-priced home in metro Denver needs to make a salary of $70,186.63 a year to qualify for a mortgage and cover basic expenses, such as property taxes and insurance, according to a report from HSH.com.

- That’s assuming a 20 percent down payment on a 30-year mortgage with an interest rate of 4.05 percent. For buyers who put down only 10 percent, the required income jumps to $80,712.

- The area median-income in Denver is $56,000 for an individual and $64,000 for a two-person household.

- The median apartment rent in metro Denver stood at $1,274 in the first quarter of 2016.

- Millennials (who represent our current and future workforce) are being trapped in the rental market as a result of inability to save and high prices.

- Denver ranks third among the top 10 cities for attracting millennials.

- Though anecdotally we hear that millennials do not want to enter the for sale housing market, evidence points to the contrary. For example, last year, 57 percent of Colorado Housing and Finance Authority (CHFA) housing customers (people seeking down payment assistance and mortgage loans) were millennials.

- At current rate millennials are saving, it would take over 17 years to save the standard 20 percent down.

- Rental burden plagues the state: See Interactive map of Colorado rent burden

Lack of affordable for-sale and rental housing

For the Denver metro area, this is an issue of low supply and high demand. And those gaps are expected to continue to increase.

According to findings from Housing Colorado, there is a shortfall of over 100,000 homes priced at an affordable level for households making less than $20,000/year, representing over 16 percent of the entire rental stock in Colorado. It is a gap that, at current rates of affordable rental housing construction of 823 homes per year, will take over 100 years to eliminate.

There is a significant pinch on affordable rental and for-sale housing resources, like tax credits and subsidies for rental housing development and down payment assistance programs. Colorado Housing and Finance Authority reports that there is a four to one demand for low-income tax credits (LIHTC) serving the homeless, transitional and deeply subsidized housing.

On a parallel track, two of the most important federal funding sources for affordable housing, HOME and Community Development Block Grant (CDBG) programs, have been cut by 59 percent and 49 percent, respectively since 2000.

Up to 4,500 currently affordable metro area units are in buildings with affordability covenants that officials say are due to expire in the next five years.

Condominiums have historically played an important role in the first-time homebuyer and affordable for-sale market. Currently, only 3.8 percent of the metro area’s new-build market is condominiums, compared to 23 percent in other major metro areas. The stark difference in condo production is mostly due to litigation concerns spawning from Colorado’s construction defects laws.

For the past three years, the legislature has failed to address key areas of construction defects laws that continue to curtail production of affordably priced condo development. As a result, condos as a share of single-family starts has dropped from 25 percent in 2007 to 3.4 percent in 2015.

In the absence of progress being made at the state legislature, municipalities took matters into their own hands by passing local construction defects ordinances. Currently, over 2.4 million Coloradans are under some type of local ordinance that addresses construction defects, but the impact of this still remains unknown.

While there are a number of resources to incentivize the development of rental properties, there are fewer resources to incentivize the development of affordable for-sale condominiums or single-family housing. Denver has an inclusionary housing ordinance (“IHO”), which requires a percentage of units above a certain threshold be affordable. However, there is an opt-out fee that allows developers to pay their way out of building these units. Additionally, most for-sale attached housing developers in the current market cycle are building properties with unit counts below the IHO threshold, diminishing the potential for net-new affordable housing units or funds from opt-out fees for affordable housing. Colorado could pilot incentives of this nature after identifying new funding sources.

According to the U.S. Department of Housing and Urban Development (HUD) the forecast for 2015-16 Denver metro area home demand (for-sale and rental) is: 58,700. We are not meeting that demand:

- 1,450 for-sale and 6,500 rental units are currently under construction

- 23,000 units are vacant that may return to market. (HUD defines vacant units as those that are not available for sale or rent—those rented or sold but not occupied; held for seasonal, recreational or occasional use; used by migrant workers; etc.)

RESULT:

The current market imbalance is pricing out renters and potential homeowners lower on the housing spectrum, putting more tension on affordable housing options and making Denver neighborhoods unaffordable for a large portion of our workforce. As bidding wars fuel rapid appreciation, some are finding themselves priced out of communities in which they’ve lived for decades. That pressure is felt across much of the housing spectrum, from those experiencing homelessness to those vying for the limited supply of entry-level for-sale housing.

There are a number of organizations tackling homelessness and affordable housing from government to nonprofit to for-profit sectors. The fact is that making a meaningful impact on this issue will take coordination among all sectors of our economy.